October 2025 Clarity Updates

The latest Clarity Data Intelligence® (Clarity) updates are now available to improve your mortgage-backed securities (MBS) experience.

Here’s what’s new:

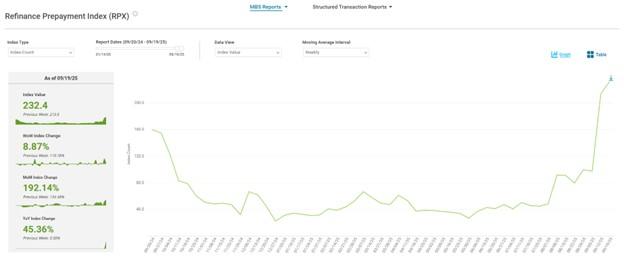

Refinance Prepayment Index (RPX) Dashboard

MBS now features the RPX Dashboard, a weekly data series that measures mortgage refinance application activity evaluated through our automated underwriting system, Loan Product Advisor® (LPA®). Leverage data as a leading prepayment indicator and discover new ways to manage prepayment risk. This dashboard will be updated every Tuesday at 10 a.m.

The RPX dashboard:

- Provides a graphical overview of the index from January 2005 to the latest week of disclosed activity.

- Highlights key performance indicators (KPIs) like weekly, monthly and year-over-year changes.

- Offers flexibility to switch between weekly data and longer-term trends with interactive moving average options.

There are two separate indices, calculated based on loan count and unpaid principal balance (UPB), respectively. The dashboard will update dynamically given the user inputs for:

- Index Type (Loan Count or UPB-based Index)

- Report Dates

- Data View (Index Value, month-over-month changes)

- Moving Average Interval (weekly: 4-week, 6-week, 12-week)

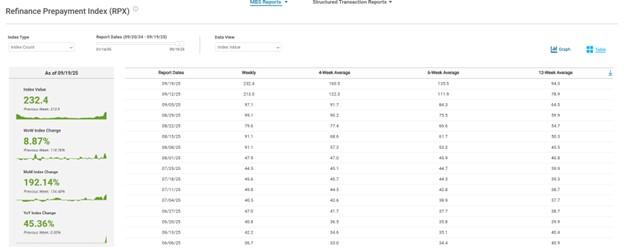

The Dashboard also features a ‘Table’ View format shown below.

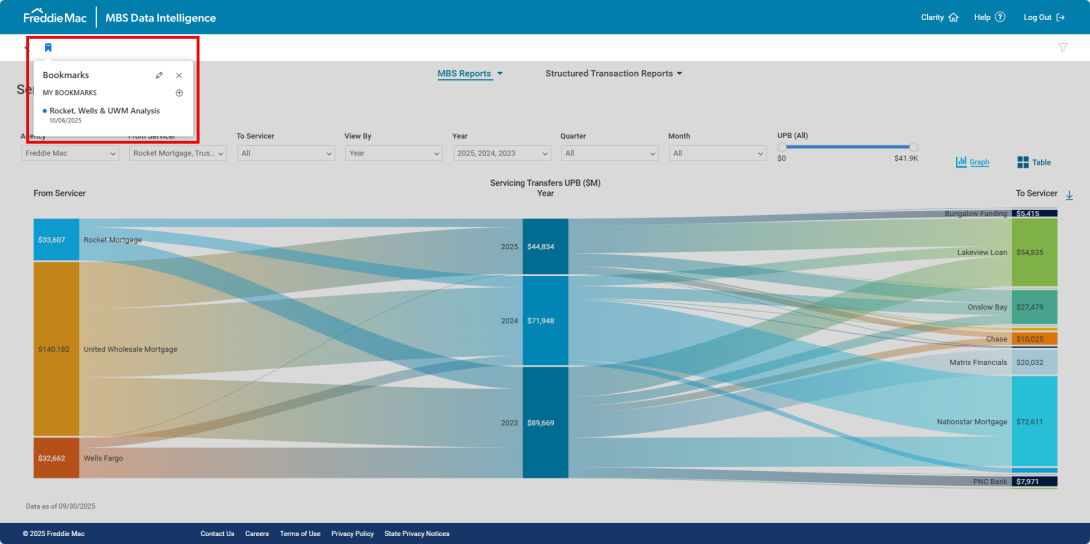

MBS Bookmark Functionality

The MBS dashboard now offers a new bookmark functionality. Save specific dropdown selections on any MBS dashboard to view these selections at any time.

Select the ribbon icon in the top left corner to bookmark the selection.