STACR ® (Structured Agency Credit Risk)

STACR is the first GSE Single-Family CRT program to issue notes that are subject to the credit and principal payment risk of reference pools of residential mortgages held in various Freddie Mac guaranteed mortgage-backed securities (MBS).

Product Summary

STACR notes are issued by a bankruptcy remote trust that is treated as a Real Estate Mortgage Investment Conduit (REMIC), a proven framework for structured credit securities. STACR reference pools are primarily made up of recently originated single-family mortgages purchased by Freddie Mac. All loans in STACR transactions undergo a rigid CRT eligibility process in addition to Freddie Mac's risk management framework for the life cycle of the loan. Pricing is paid based on tranche spread plus the 30-day compounded average Secured Overnight Financing Rate (SOFR).

Why STACR?

End to end credit risk management protocols

Large reference pools and multiple bond offerings

Programmatic issuances and active secondary market

Resources

Offerings

On-the-run Flagship Series

- DNA (actual loss) – Collateral with OLTVs 61 - 80

- HQA (actual loss) – Collateral with OLTVs 81 - 97

Off-the-Run Series

- HRP (actual loss) – HARP and Relief Refi collateral

- FTR (actual loss) – Off-the-run Non-Relief Refi Collateral

Formerly Offered Series

- DN (fixed-severity) – Collateral with OLTVs 61 - 80

- HQ (fixed-severity) – Collateral with OLTVs 81 - 97

- STACR® SPI (Securitized Participation Interests) – Fully-collateralized, non-guaranteed certificates. STACR SPI replaced an older form of fully-collateralized cash CRT securitization called WLS (Whole Loan Securities).

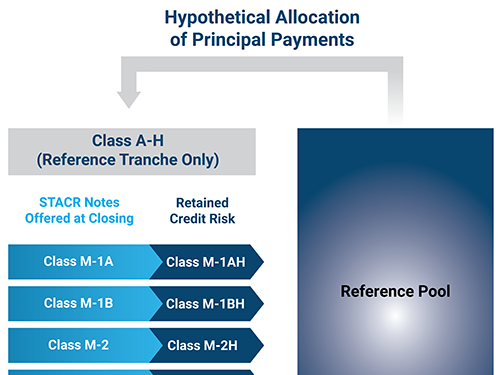

STACR REMIC Capital Structure

The STACR capital structure is a traditional senior/sub structure where principal is allocated pro rata between the senior class and subordinate classes. Within the subordinate classes, principal is allocated in sequential order. Freddie Mac retains solid alignment of interests by holding the senior reference tranche, a minimum of a five percent vertical of the capital stack, and 100% of the first-loss position. Principal payments exclude credit or modification losses within the underlying reference pools. Disposition and modification losses each follow specific hierarchies and allocation waterfalls.

Structure Highlights

- Principal is allocated monthly to the notes sequentially, similar to a senior/subordinate private label residential mortgage backed securities structure.

- Losses based on credit events in the reference pools are allocated to the STACR notes in reverse order of seniority and reduce the balance of such notes.

- Actual loss transactions issued through June 2018 have a 12.5-year final maturity, after which transactions have transitioned to term.

- Fixed severity transactions issued from 2013 to 2015 have a 10-year final maturity.

Eligibility Requirements

- STACR investments require a $10,000 minimum denomination.

- Investors must be Qualified Institutional Buyers (QIBs).