ACIS ® (Agency Credit Insurance Structure ®)

ACIS is the first GSE Single-Family CRT program to partner with global (re)insurance companies to issue insurance policies on reference pools consisting of U.S residential mortgages purchased by Freddie Mac.

Product Summary

ACIS transactions can be linked to specific STACR® (Structured Agency Credit Risk) reference pools or executed on an ACIS standalone basis. Monthly premiums are paid to (re)insurers based on their layer participation in exchange for (re)insurance coverage on a portion of the reference pool. Credit losses (including disposition and modification losses) follow specific hierarchies and allocation rules, which can trigger claims on these policies.

Why ACIS

End to end credit risk management protocols

Large, well-diversified loan pools

Multi-layer program structure allowing for risk appetite matching

Resources

Transaction Types

Flagship Series

- SPL (actual loss) – Standalone collateral with OLTVs 61 - 80

- SPH (actual loss) – Standalone collateral with OLTVs 81 - 97

- AFRMSM – Insurance coverage on eligible mortgage loans on a forward basis – as soon as they are funded by Freddie Mac – rather than after months of seasoning. AFRM replaced a previous MI-exclusive CRT offering known as Deep MI CRT.

STACR-Linked Series

- DNA (actual loss) – Collateral with OLTVs 61 - 80

- HQA (actual loss) – Collateral with OLTVs 81 - 97

Formerly Offered Series

- SAP (actual loss) – 15/20-Year Fixed-Rate Mortgages

- ARMR (actual loss) – HARP and Relief Refi collateral

- FTR (actual loss) – Off-the-run Non-Relief Refi Collateral

- DN (fixed-severity) – Collateral with OLTVs 61 - 80

- HQ (fixed-severity) – Collateral with OLTVs 81 - 97

(Re)insurer Participation

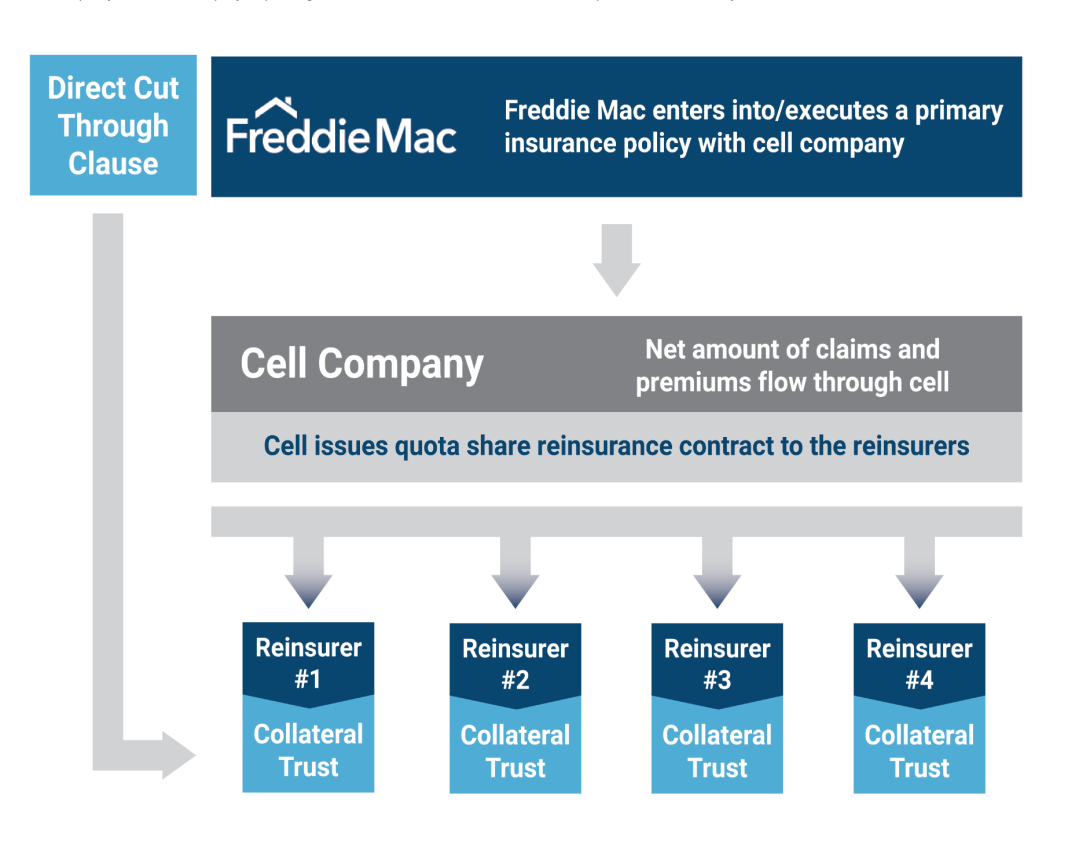

Approved counterparty (re)insurers participate in ACIS transactions through a quota share (re)insurance contract that is issued by a cell company. Freddie Mac executes a primary insurance policy with the cell company. Depending on their license, some (re)insurers also have the option to contract directly with Freddie Mac.

Structure Highlights

- (Re)insurers are required to partially collateralize their limit, driven by counterparty ratings and tranche participation.

- 20+-year mortgages have a 12.5-year legal maturity, with early call option at year 5 and early redemption option at year 10.

- 15-year mortgages have a 7.5-year legal maturity, with early call generally at year 4 and any losses on the reference pool that occur beyond year 7.5 are borne by Freddie Mac.

Eligibility Requirements

- Participants must be counterparty approved.

- (Re)insurers must also be highly-rated and well-capitalized.