Refinance Prepayment Index (RPX)

Freddie Mac’s Refinance Prepayment Index (RPX) is a weekly series that measures mortgage refinance application activity based on loan application data evaluated through Freddie Mac’s automated underwriting system, Loan Product Advisor® (LPA®). RPX is designed to serve as an early indicator of prepayments to provide investors, lenders and economists with insight to help forecast future market behavior and to better manage prepayment risk.

The weekly reporting period begins at 12:00 a.m. (ET) on Saturday and extends through 11:59 p.m. (ET) the following Friday. Three variations of the RPX are posted on a weekly basis. One that includes all refinance activity, another that only includes cash-out refinance activity and the last which only includes rate/term refinance activity.

Download RPX File Download Cash-out RPX File Download Rate/Term RPX File

RPX on Clarity Data Intelligence ®

The Refinance Prepayment Index data is also available as an interactive dashboard on Clarity Data Intelligence, our centralized hub for mortgage data.

Methodology

RPX sources data from applications received in Freddie Mac’s LPA automated underwriting system during the defined reporting period and applies the following criteria:

Only include cash-out and no cash-out refinance applications.

Only include applications that would result in the prepayment of an existing Freddie Mac mortgage.

Only include those refinance applications that meet Freddie Mac’s purchase eligibility requirements (including those loans that are approved but not eligible for delivery based on loan amounts that exceed conforming loan limits).

Only the first application received for the same borrower, property and seller will only be counted within the reporting period; no subsequent applications will be included, even if applications are repeatedly submitted in later reporting periods.

Exclude refinance applications on second liens and pre-qualifications.

A refinance application for the same borrower, property and seller will be counted at most once per reporting period. It will only be included again in a subsequent period if the record was not evaluated in the previous two months, or if the application reflects a change in interest rate (i.e., rate re-locks).

The criteria are applied to all refinance applications received in LPA beginning with the week ending on January 14, 2005. All refinance applications received during the defined reporting period are summarized as a total loan count and total aggregate loan amount that are then presented as a percentage relative to the benchmark period of January 14, 2005. Unlike traditional approaches that compare absolute application volumes to a fixed benchmark period, RPX measures the number of refinance applications relative to the total outstanding Freddie Mac securitized portfolio as of each reporting period, effectively adjusting for portfolio growth over time. For comparison, the RPX will also provide loan count and total aggregate loan amount index values that have not been adjusted for our portfolio growth over time.

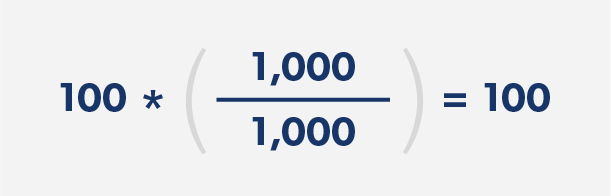

For example, if 1,000 refinance applications are received in the weeks ending 1/14/2005 and 10/10/2025, an unadjusted index would be calculated as:

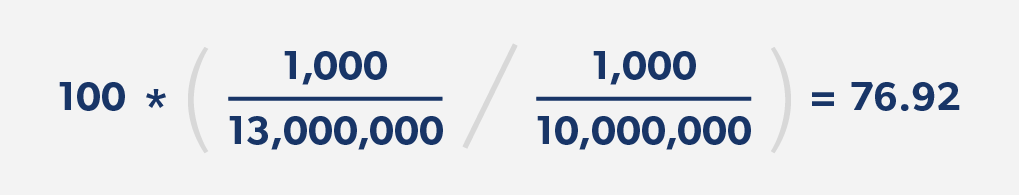

Under the adjusted RPX methodology, with 10 million loans outstanding in 2005 and 13 million in 2025, the adjusted index is determined as:

This adjustment ensures the RPX index accurately reflects changes in the size of the loan portfolio over time. A similar calculation is performed for the UPB based index.

Publication Schedule

The RPX weekly updates will be published every Tuesday morning at 10:00 AM (ET) in three cumulative files that will be appended each week with data from the prior week. The RPX file names are static, but the data is updated weekly and provides the ending date of each reporting period within the file.

RPX File Specification

| Position | Attribute Name | Attribute Description | Data Type | Max Length | Format |

|---|---|---|---|---|---|

| 1 | WK_ENDING | The ending date for the weekly period (Saturday-Friday). | Date | 10 | MM/DD/YYYY |

| 2 | WK_RPX_ADJ_CNT | Indexed value represents the adjusted loan count of eligible refinance applications observed in the reporting period. Accounts for portfolio growth over time. | Decimal | 6 | 3.2 |

| 3 | WK_RPX_ADJ_UPB | Indexed value represents the adjusted UPB of eligible refinance applications observed in the reporting period. Accounts for portfolio growth over time. | Decimal | 6 | 3.2 |

| 4 | WK_RPX_UNADJ_CNT | Indexed value represents the unadjusted loan count of eligible refinance applications observed in the reporting period. | Decimal | 6 | 3.2 |

| 5 | WK_RPX_UNADJ_UPB | Indexed value represents the unadjusted UPB of eligible refinance applications observed in the reporting period. | Decimal | 6 | 3.2 |

Cash-out RPX File Specification

| Position | Attribute Name | Attribute Description | Data Type | Max Length | Format |

|---|---|---|---|---|---|

| 1 | WK_ENDING | The ending date for the weekly period (Saturday-Friday). | Date | 10 | MM/DD/YYYY |

| 2 | WK_RPX_CO_ADJ_CNT | Indexed value represents the adjusted loan count of eligible cash-out refinance applications observed in the reporting period. Accounts for portfolio growth over time. | Decimal | 6 | 3.2 |

| 3 | WK_RPX_CO_ADJ_UPB | Indexed value represents the adjusted UPB of eligible cash-out refinance applications observed in the reporting period. Accounts for portfolio growth over time. | Decimal | 6 | 3.2 |

| 4 | WK_RPX_CO_UNADJ_CNT | Indexed value represents the unadjusted loan count of eligible cash-out refinance applications observed in the reporting period. | Decimal | 6 | 3.2 |

| 5 | WK_RPX_CO_UNADJ_UPB | Indexed value represents the unadjusted UPB of eligible cash-out refinance applications observed in the reporting period. | Decimal | 6 | 3.2 |

Rate/Term RPX File Specification

| Position | Attribute Name | Attribute Description | Data Type | Max Length | Format |

|---|---|---|---|---|---|

| 1 | WK_ENDING | The ending date for the weekly period (Saturday-Friday). | Date | 10 | MM/DD/YYYY |

| 2 | WK_RPX_RT_ADJ_CNT | Indexed value represents the adjusted loan count of eligible rate/term refinance applications observed in the reporting period. Accounts for portfolio growth over time. | Decimal | 6 | 3.2 |

| 3 | WK_RPX_RT_ADJ_UPB | Indexed value represents the adjusted UPB of eligible rate/term refinance applications observed in the reporting period. Accounts for portfolio growth over time. | Decimal | 6 | 3.2 |

| 4 | WK_RPX_RT_UNADJ_CNT | Indexed value represents the unadjusted loan count of eligible rate/term refinance applications observed in the reporting period. | Decimal | 6 | 3.2 |

| 5 | WK_RPX_RT_UNADJ_UPB | Indexed value represents the unadjusted UPB of eligible rate/term refinance applications observed in the reporting period. | Decimal | 6 | 3.2 |

Additional Information

The information contained in the reports and other documents that may be accessed on this page is provided for your general information only and speaks only as of the date of those documents. Numerous assumptions were used in preparing the information, which may or may not be reflected herein. As such, no assurance can be given as to the information’s accuracy, appropriateness or completeness in any particular context. The information could be out of date and no longer accurate. Freddie Mac undertakes no obligation, and disclaims any duty, to update any of the information in those documents. Opinions contained in the reports are those of Freddie Mac as of the date indicated and are subject to change without notice. The information and opinions expressed herein should not be construed as either projections or predictions of value, performance or results, nor as legal, tax, financial or accounting advice. All content is provided on an “as is” basis, with no warranties of any kind whatsoever. The information in the reports is generally subject to the same risks and limitations as our cohort-, pool- and loan-level information, as described in the offering circulars for our UMBS, MBS and PCs.

This is not an offer to buy or sell any Freddie Mac securities. Offers for any given security are made only through applicable offering circulars and related supplements, which incorporate our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (SEC); all other reports Freddie Mac files with the SEC pursuant to Section 13(a) of the Securities Exchange Act of 1934 (Exchange Act), excluding any information “furnished” to the SEC on Form 8-K; and all documents that Freddie Mac files with the SEC pursuant to Sections 13(a), 13(c) or 14 of the Exchange Act, excluding any information “furnished” to the SEC on Form 8-K.

The financial and other information contained in the reports and other documents is not incorporated by reference into, or a part of, any offering documents for any security. The information does not constitute a sufficient basis for making a decision with respect to the purchase and sale of any security and is directed only at, and is intended for distribution to and use by, qualified persons or entities in jurisdictions where such distribution and use is permitted and would not be contrary to law or regulation. All information regarding or relating to Freddie Mac securities is qualified in its entirety by the relevant offering circular and any related supplements. You should review the relevant offering circular and any related supplements before making a decision with respect to the purchase or sale of any security. In addition, before purchasing any security, please consult your legal and financial advisors for information about and analysis of the security, its risks and its suitability as an investment in your particular circumstances.

These materials may contain forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties, some of which are beyond the company’s control. Management’s expectations for the company’s future necessarily involve a number of assumptions, judgments and estimates and various factors could cause actual results to differ materially from the expectations expressed in these and other forward-looking statements. These assumptions, judgments, estimates and factors are discussed in the company’s most recent Annual Report on Form 10-K and its reports on Form 10-Q and Form 8-K, which are available on the Investor Relations page of the company’s website at https://www.freddiemac.com/investors and the SEC’s website at www.sec.gov. The company undertakes no obligation to update forward-looking statements it makes to reflect events or circumstances occurring after the respective dates of the reports and other documents.