Re-Performing Loan (RPL) Senior/Subordinate Offerings

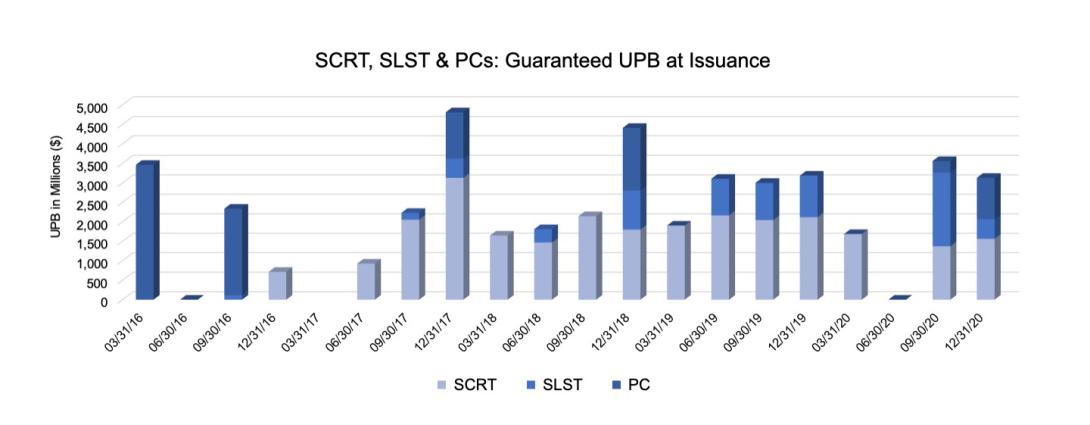

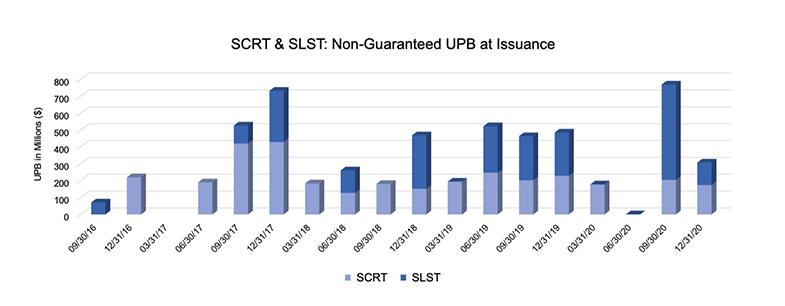

Freddie Mac securitizes re-performing single-family mortgage loans (”RPLs”) into senior/subordinate securities (via SCRT and SLST programs) and Freddie Mac PCs. These are important tools for the company to effectively manage risk of its mortgage-related investments portfolio.

Overview

Freddie Mac RPL Senior/Sub Securitization Programs: SCRT & SLST

- Offerings of securities backed by RPLs generally include senior securities guaranteed by Freddie Mac and non-guaranteed subordinate securities.

- Designed to provide flexibility to manage credit and market risk.

- Bond and loan level disclosures provide transparency on performance and borrower outcomes.

SEASONED CREDIT RISK TRANSFER TRUST (“SCRT”)

- Underlying RPLs were either previously securitized in Freddie Mac PCs or Freddie Mac Uniform Mortgage-Backed Securities or held by Freddie Mac in whole loan form. The majority of the loans were previously modified under a GSE HAMP or other non-HAMP modification program, including Payment Deferrals.

- Backed by seasoned, minimum 6+ months clean-pay RPLs, and may have forborne UPB. REMIC structure

- Includes Guaranteed Senior, Non-Guaranteed Subordinate, Mortgage Insurance, and Non-Economic Residual Certificates.

- Syndicated sale of guaranteed senior and unguaranteed subordinate securities

- Guarantee of timely payment of interest and payment of principal on the Guaranteed Certificates, including payment in full by the Stated Final Distribution Date.

- The Subordinate Certificates are cross-collateralized across all groups.

- After settlement, the RPLs are serviced in accordance with a Pooling and Servicing Agreement and no longer serviced to the Freddie Mac Guide.

- Freddie Mac is the Sponsor, Trustee, and Seller of the SCRT trust, selects the servicers for the SCRT trust, and has Guarantor oversight and audit rights with respect to the servicing.

- Freddie Mac may offer repo financing for certain SCRT Guaranteed Senior Certificates to approved counterparties.

SEASONED LOANS STRUCTURED TRANSACTION (“SLST”)

- Backed by seasoned, moderately delinquent RPLs, generally with less than 6 months clean-pay, and may have forborne UPB.

- REMIC structure

- Two part transaction:

- Auction of the right to purchase subordinate securities

- Syndicated sale of the guaranteed senior securities

Subordinate Certificates Auction:

- Bid process for right to purchase subordinate securities on closing date.

- Potential bidders must be approved by Freddie Mac.

- The bidder qualification process is similar to our NPL Bidder Qualification process.

- Bids are submitted in accordance with a term sheet governing the auction and the subsequent securitization.

- The auction winner has the right to appoint a Securitization Servicer post-closing, subject to Freddie Mac approval, and to name a Collateral Administrator who will be engaged to oversee the servicing and management of the RPLs subject to a Pooling and Servicing Agreement. Prospective bidders may review the agreement prior to bidding.

- The winning bidder must agree to retention requirements of the subordinate certificates for certain time periods after settlement.

Guaranteed Senior Certificates:

- Freddie Mac will syndicate the Guaranteed Senior Certificates (and may retain certificates), effectively providing financing to the purchaser of the Subordinate Certificates, who will retain flexibility and control for customized management of the RPLs.

- Freddie Mac has a 10-year Mandatory Repurchase Obligation on the Guaranteed Certificates and typically offers front and back sequential bonds.

- Guarantee of timely payment of interest and the payment of principal, including payment in full by the Stated Final Distribution Date.

- Freddie Mac is the Sponsor, Trustee, and Seller of the SLST trust and has Guarantor oversight and audit rights with respect to the servicing.

- Freddie Mac may offer repo financing for certain SLST Guaranteed Senior Certificates to approved counterparties.