November Updates to Clarity

The latest Clarity Data Intelligence® (Clarity) updates went live this past weekend with functionality and dashboard enhancements to improve your experience for both Credit Risk Transfer (CRT) and mortgage-backed securities (MBS).

Here’s what’s new:

CRT Updates

Additional Filters on the Transition Matrix

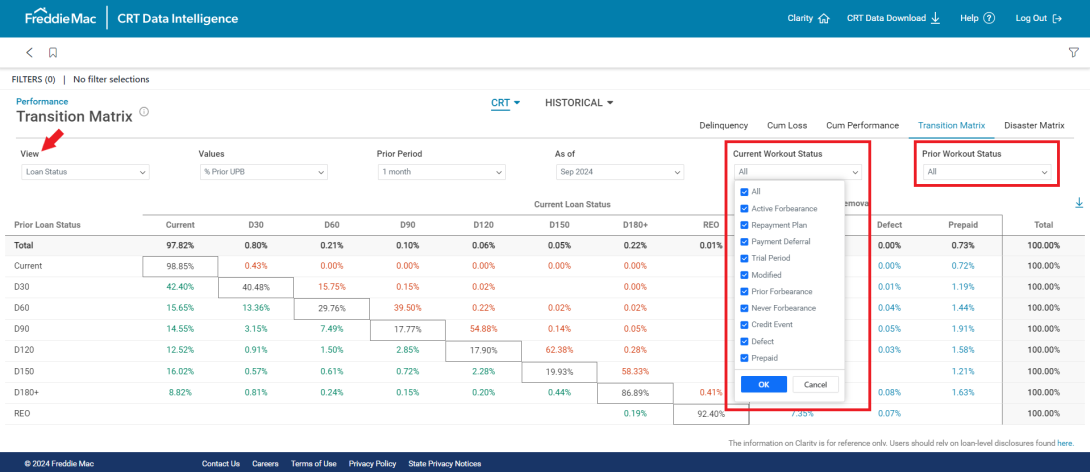

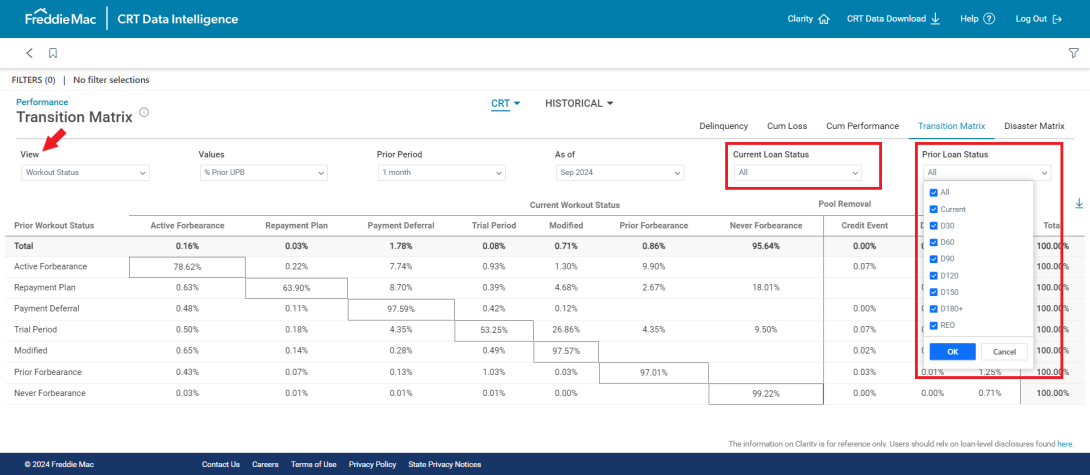

The Performance Transition Matrix dashboard now features two additional dropdowns, allowing you to filter the dashboard by Current & Prior Period Workout Status or Current & Prior Period Loan Status, based on the selected view. With these added filters, you can get a clearer view of how loans of selected statuses transition across payment or workout statuses from period to period.

View by Loan Status

View by Workout Status

MBS Updates

Our Affordable & Green MBS Issuance Volume dashboard has been expanded to include new categories highlighting our labeled Social MBS and renamed to Affordable, Social & Green MBS. Previously, this report showed issuance volume by month across three distinct categories: Home Possible®, HFA Advantage® and Green MBS. With the introduction of our new Social MBS, the categories now include:

- Home Possible/Social

- Home Possible

- Social MBS

- HFA Advantage/Social

- HFA Advantage

- Green MBS/Social

- Green MBS

- Fannie Mae equivalents –

- HomeReady (vs. Home Possible)

- HFA Preferred (vs. HFA Advantage)

Note: HomeReady® and HFA PreferredTM are properties of Fannie Mae.

As part of this update, a new filter has been added to the report to provide the option to select all Social or Non-Social categories as a group, in addition to the option to select individual categories.

Freddie Mac has issued labeled Social MBS since June 2024. Learn more about our Single-Family Social Bonds.