Mission Index

Gain insight into Freddie Mac’s mission-oriented lending activity.

Freddie Mac’s Mission Index provides investors insights into the mission-oriented lending activities underlying our single-family mortgage-backed securities (MBS). It is an important tool for investors to help drive affordable lending and create homeownership opportunities for more borrowers, in more communities.

The Mission Index scores each Single-Family MBS issued by both Freddie Mac and Fannie Mae based on nine* criteria, all of which align to our mission objectives. Below, learn more about the Mission Index and how to estimate the concentration of mission-oriented loans in your portfolio.

*Effective July 1, 2025, Freddie Mac no longer purchases loans originated through a SPCP.

How Does Freddie Mac’s Mission Index Work?

Freddie Mac's Mission Index is calculated based on several dimensions and criterion. Explore our methodology and example scoring below.

Methodology

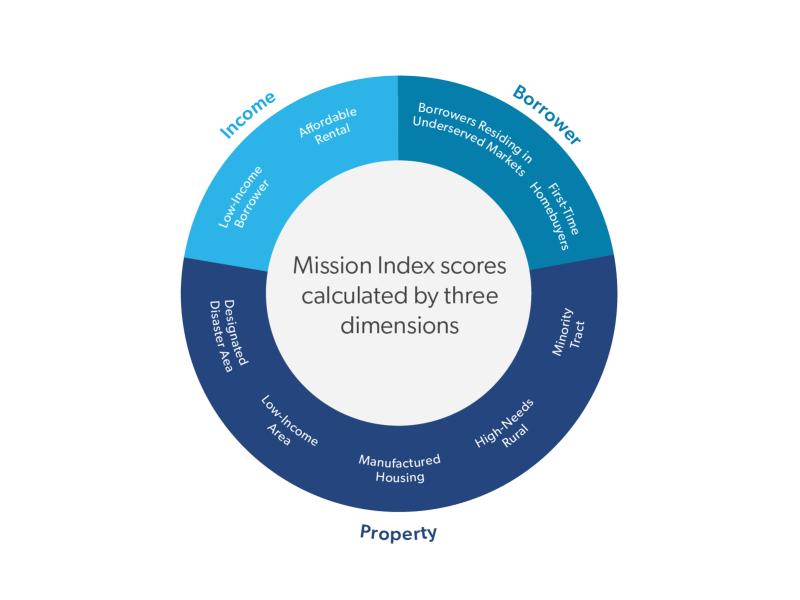

Mission Index scores are calculated based on three dimensions:

Income, Borrower and Property.

Each dimension is made up of specific mission criteria. There are a total of nine criteria for the three dimensions. Every loan sold to Freddie Mac is evaluated against each criterion.

Please reference the Mission Index guide for more information on each of the underlying mission criteria.

*Mission Index Version 1.1 is applicable for eligible pools issued beginning June 2024.

Mission Criteria Share (MCS)

The Mission Criteria Share (MCS) is a percentage of loans in a security that satisfy at least one of the nine mission criteria.

If a loan meets at least one of the criteria, then the loan-level dimension score will be at least 1 and will contribute to the pool-level MCS.

For example, if 89 loans in a 100 loan pool satisfy at least one criterion, the MCS is 89%.

*Effective July 1, 2025, Freddie Mac no longer purchases loans originated through a SPCP.

Mission Density Score (MDS)

The Mission Density Score (MDS) is a pool-level score representing the average number of dimensions for which each mortgage loan qualifies.

A loan may have a maximum loan-level score of three — representing one point for each dimension. However, the MDS ranges from 0 - 2.5 to minimize privacy concerns in cases where all three mission dimensions are met. In the example to the right, each mission dimension is satisfied and the MDS is 2.5.

Example Methodology

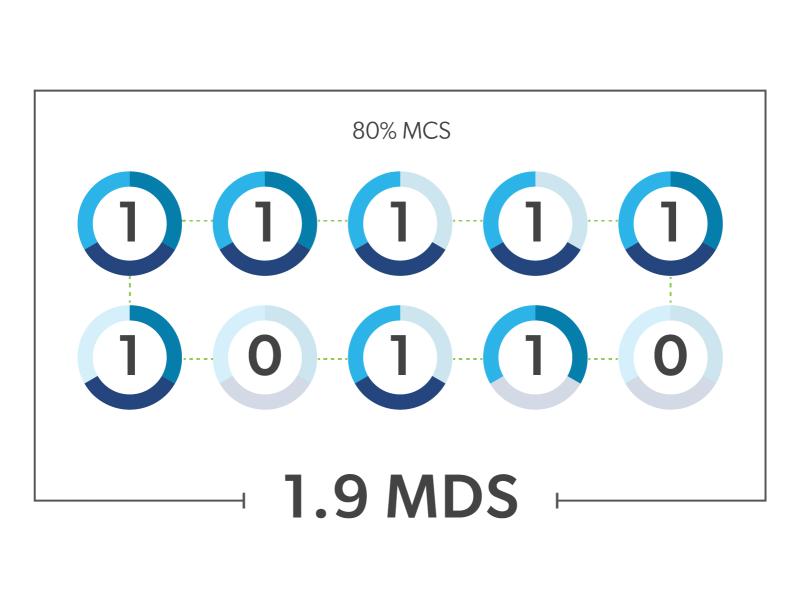

Here is a methodology illustration for a hypothetical pool of 10 loans. Of the 10 loans, eight satisfy at least one mission criteria. Likewise, of the total 30 mission dimensions across these loans, 19 are satisfied.

Therefore, in this example, the MCS is 80% and the MDS is 1.9.

Mission Index Criteria Attribution (MICA) Disclosure Supplement

A cohort-level disclosure supplement that allows investors to estimate share of the Mission Index criteria on their portfolio.