Supers

Product Overview

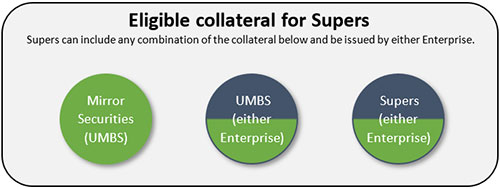

Supers are single class resecuritizations of UMBS, which are 55-day TBA-eligible securities. Each Supers security will be issued and guaranteed by either Fannie Mae or Freddie Mac. Supers can be backed by:

- UMBS or other Supers (either issuances of one Enterprise or a commingling of issuances of both Enterprises) and/or

- Existing TBA–eligible MBS and/or Megas issued by Fannie Mae and/or

- Legacy TBA-eligible PCs and/or Giant PCs issued by Freddie Mac that have been exchanged and pay on a 55-day delay schedule.

Supers are pass-through securities, each representing an undivided interest in a pool of residential mortgages. Freddie Mac and Fannie Mae offer traditional 30-year fixed-rate Supers in addition to 20-year, 15-year, and 10-year securities.

Supers differ from U.S. Treasury securities and other fixed-income investments in two ways. First, they can be prepaid at any time since the underlying mortgages can be paid off by homeowners prior to a loan’s maturity. Mortgage-backed securities generally provide a higher nominal yield than certain other fixed-income products due to this implicit call option. Second, Supers are not backed by the full faith and credit of the United States, as are U.S. Treasury securities. However, Freddie Mac guarantees the timely payment of interest and principal on all Supers. Supers feature a payment delay of only 55 days from the time interest begins to accrue and the time the investor receives a payment.

Commingled Supers

UMBS pass through collateral, new issue or exchanged UMBS and Supers issued by either Agency may be commingled to back Supers issued by either Agency.

Formation Guidelines:

- Dealers can form Supers on behalf of their customers using Freddie Mac’s Dealer Direct web portal.

- Please reference the Collateral Prefix Eligibility Chart and Pooling Requirements. 55-day Giant/Supers Collateral Prefix Eligibility Chart and 55-day Fixed-rate Giant/Supers Pooling Requirements.

- Newly formed UMBS pools are eligible for Supers the same day they are settled with the exception of the last business day of the month.

- Previously formed 55-day UMBS and Supers are eligible collateral for new 55-day Supers.

- If your Supers collateral requires a 45-day to 55-day exchange, additional time is required to allow for the exchange settlement prior to the Supers settlement. Please visit our Gold PC Exchange website for more details.

- For assistance with the execution of a Supers, please email [email protected].

Additional Resources

This product overview is not an offer to sell or solicitation of an offer to buy any Freddie Mac securities. Offers for any given security are made only through applicable offering circulars and related supplements, which incorporate Freddie Mac’s Information Statement and related supplements.