February 2025 Clarity Updates

The latest Clarity Data Intelligence®(Clarity) updates went live this past weekend to improve your Credit Risk Transfer (CRT) and Mortgage-Backed Securities (MBS) experience.

Here’s what’s new:

CRT Updates

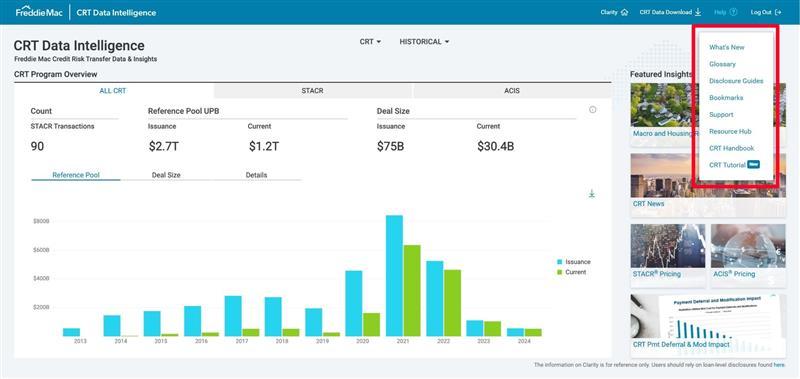

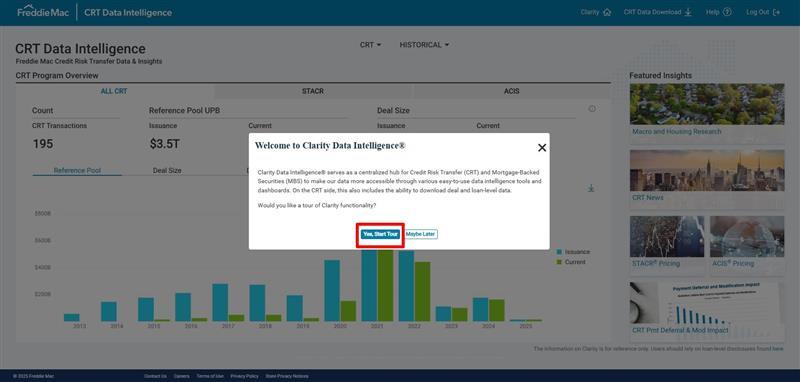

New CRT Tutorial

The CRT Tutorial provides a step-by-step walkthrough of the CRT Data Intelligence tools and dashboards. Learn how to navigate the various pages on Clarity to efficiently access and analyze CRT data.

To access the tutorial, visit the Help Menu on CRT Data Intelligence and start your tour.

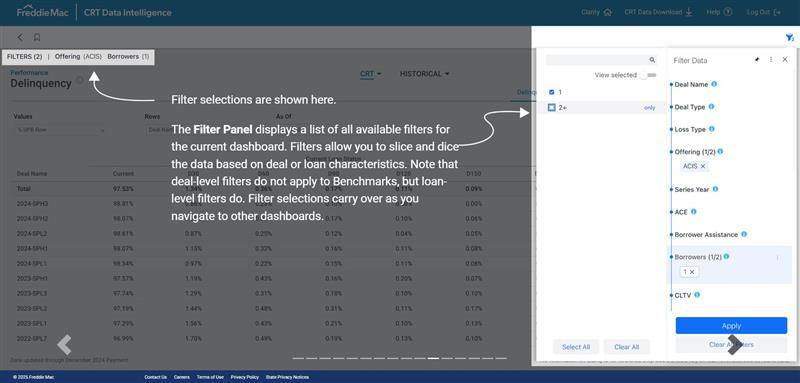

Enjoy this guide to Clarity’s key functionalities, including Bookmarks, Dynamic Filters (shown below), Benchmarks and more.

MBS Updates

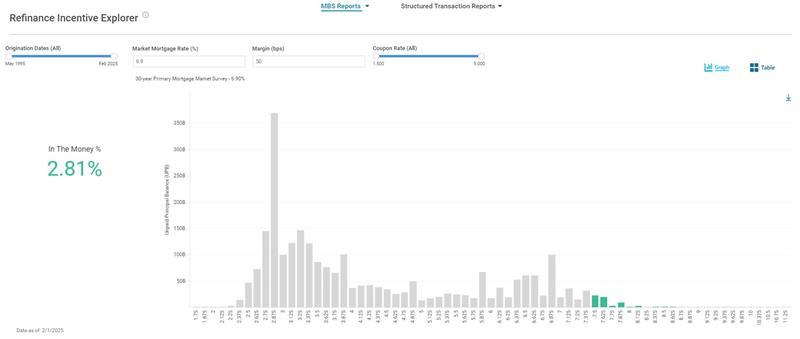

New Refinance Incentive Explorer Dashboard

This dashboard allows users to explore how much of Freddie Mac’s outstanding securitized 30-year to be announced (TBA) portfolio has an interest rate incentive to refinance given current market conditions, as well as to analyze alternative scenarios when mortgage rates move up or down. The dashboard also provides the ability to focus on targeted subsets of the portfolio by selecting specific origination periods and security coupon ranges.

This dashboard displays the volume of outstanding securitized 30-year TBA loans that have refinance incentive, or are in the money, at a given market mortgage rate. The percent and distribution of loans that are in the money will dynamically update given the user inputs for:

- Market mortgage rate.

- Incentive margin.

- Coupon ranges.

- Origination dates.

Loans are binned together by weighted average coupon (WAC) in 1/8th percentage point increments for readability. The in-the-money percentage displayed is based on the un-binned note rates. The data represented in the dashboard always reflects the outstanding loan population as of the latest available factor date.