Two New Seller-Level Dashboards Now Available in MBS Clarity

We’re introducing two new Seller–level dashboards to Clarity, effective July 2024. One will focus on loan characteristics, and the other will focus on prepayments.

The Seller-Level Loan Characteristics dashboard shows the percentage of issuance Unpaid Principal Balance (UPB) for selected loan characteristics. This report can be filtered by a single loan characteristic, a single Seller name and single or multiple quarters. This can help investors identify changes in business mix by loan characteristics and may help target opportunities for investment. It also helps Sellers benchmark themselves against the rest of the government sponsored enterprise (GSE) market.

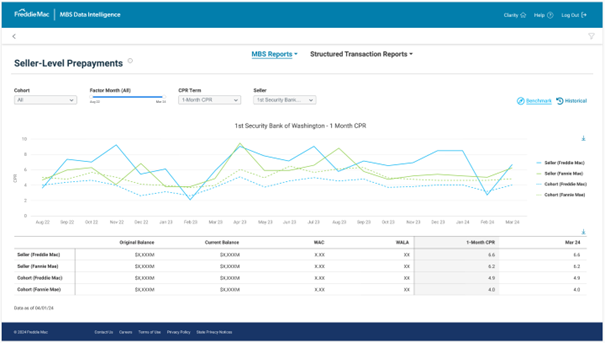

The Seller-Level Prepayment dashboard illustrates historical prepayment rates by factor date at the Seller-level and cohort-level, which allows users to quickly compare prepayment speeds and behavior trends between Sellers and the overall cohort. This report can be filtered by a single cohort, a single Seller and a single conditional prepayment rate (CPR) term.

There are also various dashboards on Real Estate Mortgage Investment Conduit (REMIC) issuance and other information related to REMIC under the Structured Transaction Reports. These two new dashboards can be found under the MBS Data Intelligence – MBS Reports section of Clarity.

Seller-Level Loan Characteristics Dashboard Example:

Seller-Level Prepayments Dashboard example: