March 2024 Updates to Clarity

The latest Clarity Data Intelligence® (Clarity) updates went live this past weekend and improve your experience with revamped landing pages for both Credit Risk Transfer (CRT) and Mortgage-Backed Securities (MBS), and new functionality and dashboard enhancements.

Here’s what’s new:

CRT Updates

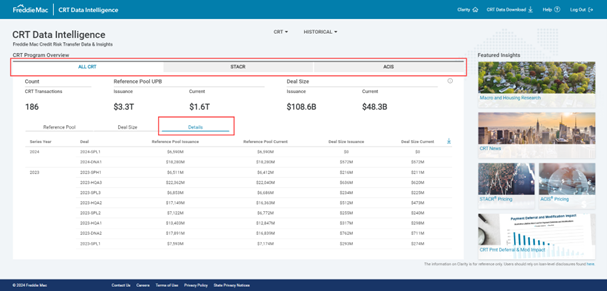

Revamped Landing Page

By redesigning the CRT landing page, we’ve made it easier to find the information you’re looking for. We’ve split the program statistics and charts into All CRT, STACR® and ACIS® tabs.

Each of those tabs include a Details table that shows the Reference Pool UPB and Deal Size for each transaction.

Finally, we’ve updated the Featured Insights section on the right of the page to provide even more helpful links.

New Clarity CRT Landing Page

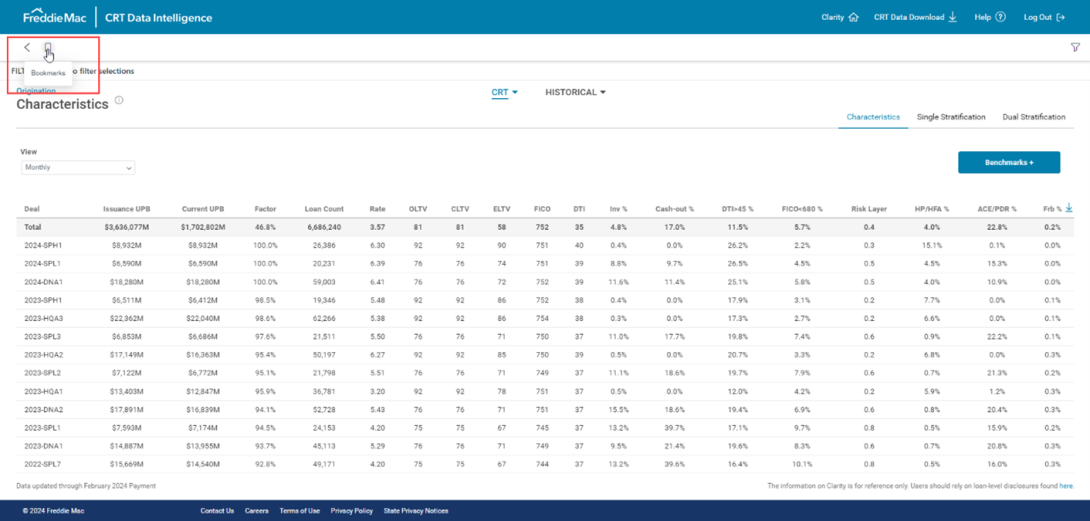

New Bookmarks Save Filter and Dropdown Selections

You asked. We listened. Now you can save time with our new Bookmarks functionality that allows you to save filter and most dropdown selections on a specific dashboard so that you can easily reload them later.

Just look for the ribbon icon in the top left corner of the dashboard to save your selections for that dashboard.

Bookmarks Ribbon Icon

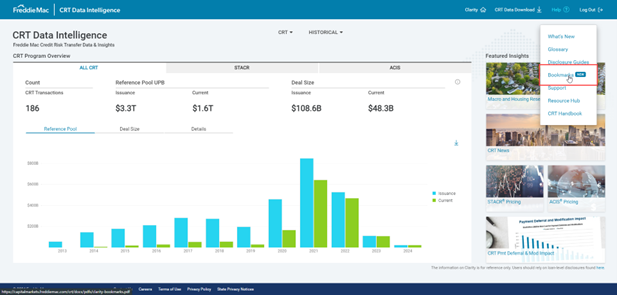

Check out our Bookmarks Guide to learn how to get the most out of this new feature. You can also easily access the Bookmarks Guide from the new Bookmarks link in the Help menu.

Bookmarks Guide Link in the Help Menu

MBS Updates

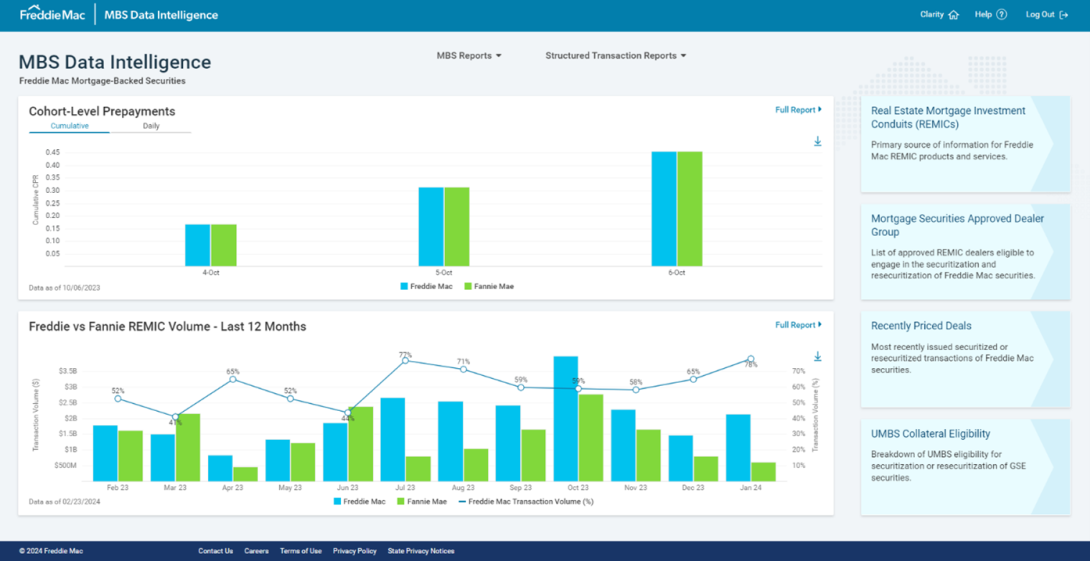

Redesigned Landing Page

The new MBS landing page offers faster access to information you want and a new layout that looks and feels more like the CRT landing page for a more consistent experience.

We’ve added the Cohort-Level Prepayments dashboard to the landing page, so this information is right at your fingertips without having to navigate to it. We’ve also enhanced navigation by providing links to relevant dashboards on the right side of the page.

New MBS Landing Page

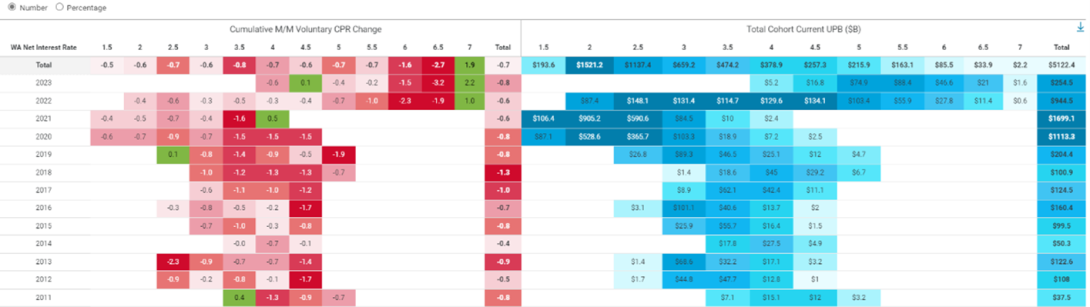

Prepayment Heatmap Dashboard Enhancement

We’ve added Fannie Mae data to our Prepayment Heatmap Dashboard. Now you can have a combined view of how government-sponsored enterprise (GSE) conventional payoffs are trending relative to the prior month – or a look at Freddie Mac or Fannie Mae data independently.

Prepayment Heatmap Dashboard

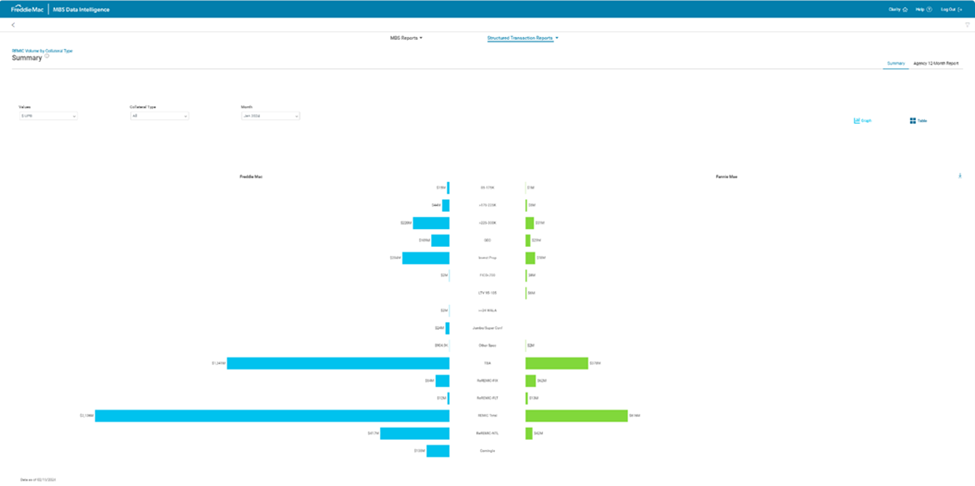

New REMIC by Collateral Type Dashboards

We’ve added new Butterfly and Heatmap dashboards that provide a view of Real Estate Mortgage Investments Conduits (REMICs) by collateral type. Both dashboards will generally be updated every month. However, collateral designations and characteristics within a category may vary between the GSEs.

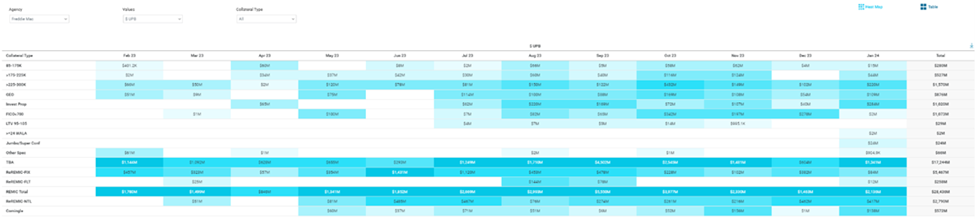

The Heatmap dashboard shows collateral types used in a selected month across the GSEs, with each month available on a rolling 12-month basis. Collateral categories include:

- Loan UPB size at origination

- Loan-to-value (LTV) ratio at origination

- Selected geographic information

- Credit score range

- Commingled versus single agency

- Pools vs Re-REMICs

- Other credentials

You can choose between the categories by selecting the appropriate filters.

The Butterfly dashboard shows the same rolling 12-month basis as the Heatmap dashboard, but also shows a comparison of the GSEs across the categories. The Butterfly dashboard includes the same collateral categories as the Heatmap dashboard and you choose them by using the same filters.

REMIC by Collateral Type Butterfly Dashboard

REMIC by Collateral Type Heatmap Dashboard

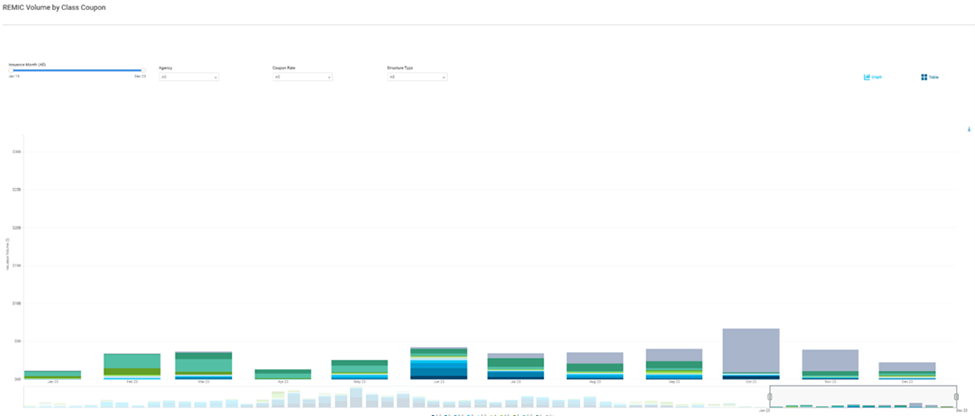

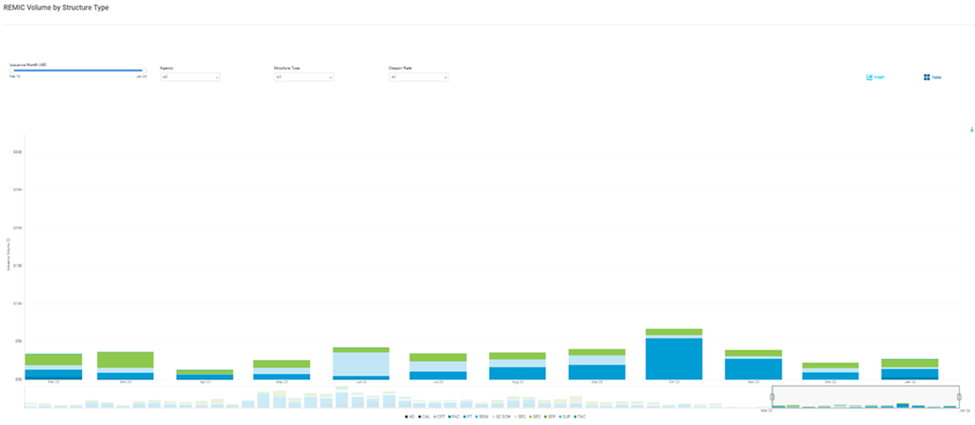

REMIC by Class Coupon and REMIC by Class Structure Type Dashboards Updates

These two dashboards have been updated to allow you to analyze specific periods within the selected issuance months.

REMIC by Class Coupon Dashboard

REMIC by Structure Type Dashboard

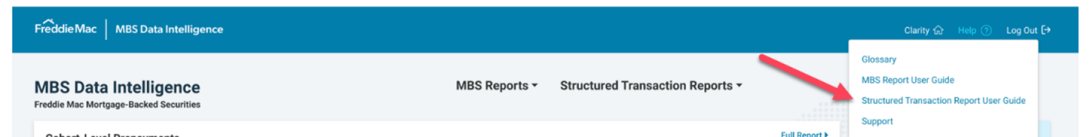

New Structured Transaction Reports User Guide

We’ve developed a new Structured Transaction Reports User Guide that’s designed to help you get the most out of the Clarity MBS Structured Transaction Reports. It provides helpful tips on navigation, provides info to help you interpret results and explains how the numbers in the reports are derived. Five main reports/dashboards are available:

- REMIC by Agency

- REMIC by Collateral

- REMIC by Class Coupon

- REMIC by Structure Type

- LIBOR Resecuritization vs. SOFR Issuance (REMIC by Floater Issuance)

You can access the Structured Transaction Reports User Guide through the Help function in Clarity.

Structured Transaction User Guide Access