Product FAQs

The following Q&A are for informational purposes only and do not constitute disclosure. Freddie Mac assumes no responsibility to update this information.

UMBS, Freddie Mac MBS, Gold PCs

What are the differences between a UMBS vs MBS vs PC?

As part of the Single Security Initiative, Freddie Mac has begun issuing 55-day Uniform Mortgage-Backed Securities (UMBSTM), which are TBA-eligible single-class securities backed by single family mortgage loans purchased by Freddie Mac. In addition, simultaneously with the implementation of the Single Security Initiative Freddie Mac now issues non-TBA-eligible 55-day mortgage securities referred to as a Freddie Mac MBS. All new Freddie Mac single-family fixed-rate securities are now issued with a 55-day payment delay.

Issued prior to implementation of the Single Security Initiative, a Participation Certificate (PC) is a single-class security backed by single family mortgage loans purchased by Freddie Mac that are either fixed-rate or adjustable-rate (ARM) mortgages. A Fixed-Rate Gold PC has a 45-day payment delay, whereas an ARM PC has a 75-day payment delay. As of June 3, 2019, Freddie Mac will no longer issue 45-day Gold PCs, however, Freddie Mac will continue to offer 75-day ARM PCs.

The product names for a resecuritization (i.e., Level 2) of PCs, MBS and/or UMBS, that are offered by Freddie Mac, are described in the chart below.

| Product Name (Level 1) | Product Name (Level 2) | Payment Delay |

|---|---|---|

| UMBS | Supers™ | 55-day |

| MBS | Giant MBS | 55-day |

| Fixed-Rate Gold PC | Fixed-Rate Gold Giant PC | 45-day |

| ARM PC | ARM Giant PC | 75-day |

What are the features of Freddie Mac UMBS and MBS?

Freddie Mac has moved to a 55-day payment delay for newly issued and exchanged UMBS and MBS. UMBS issued by Freddie Mac will be fungible with UMBS issued by Fannie Mae. UMBS issued by either Enterprise will follow the same structure of prefixes and pool numbers.

TBA prefixes for UMBS and resecuritizations of UMBS (i.e., Supers) issued by either Enterprise will align to the following table:

| Product | UMBS and Supers Prefixes |

|---|---|

| 30-year | CL |

| 20-year | CT |

| 15-year | CI |

| 10-year | CN |

Each Enterprise has been assigned a range of pool numbers to issue UMBS. Freddie Mac has been allotted pool numbers beginning in Q-Z, Fannie Mae has been allotted pool numbers beginning in A-I, and M.

Freddie Mac MBS are not fungible with Fannie Mae securities. They may be pooled together with other Freddie Mac MBS in a Giant MBS. Freddie Mac MBS will follow the same three-character (two used) prefix field plus a separate 6-character pool number format as UMBS.

How does the market find out about new UMBS, MBS, or PCs?

Freddie Mac generally discloses new UMBS, MBS, or ARM PCs two to four business days (depending on the funding cycle) before settlement in the Daily Issuance Security Files. Daily Issuance Security Files can be accessed from the Freddie Mac Security Data website or through disclosure data vendors.

All pools are shown with an issue date of the 1st of the month regardless of the actual date of settlement within the month.

What are the minimum principal and transfer amounts for UMBS, MBS, or PCs?

Holders must hold and transfer UMBS/MBS/PCs in minimum original principal amounts of $1,000 and additional increments of $1. A holder may not transfer UMBS/MBS/PCs that have a balance of less than $1,000.

Does Freddie Mac have a 1% clean-up call on UMBS, MBS, or PCs?

Freddie Mac pools are not redeemable and do not have a 1% clean-up or any other type of call feature.

In a TBA trade, when will I know whether my UMBS was issued by Freddie or Fannie?

The UMBS issuer will be disclosed to the investor 48 hours before the security is delivered.

What loan terms are pooled by Freddie Mac?

Freddie Mac pools 30-, 20-, 15-, and 10-year securities.

Where can I find more information about exchanging Freddie Mac 45-day securities for UMBS and MBS 55-day securities?

On Freddie Mac’s exchange website you can find an overview of the exchange process, the two operational paths, booking and settlement guides, details on exchange disclosures and float compensation payments and more.

What changes have occurred for Freddie Mac UMBS, MBS, and PC disclosures?

As part of the Single Security Initiative, Freddie Mac and Fannie Mae have largely aligned our pool disclosures. An ‘Issuer’ field has been added to disclosure files and Freddie has created several new disclosures specific to the Exchange process. Due to concerns about borrower privacy, both Enterprises have masked or removed certain loan-level attributes.

These disclosures can be accessed through Fannie Mae and Freddie Mac’s websites or through certain approved vendor distributors.

Why has the ARM Weighted Average Net Interest Rate (PC coupon) changed even though it hasn't reached the first adjustment date?

The Weighted Average Net Interest Rate (also known as the PC coupon) is a weighted average of the individual mortgage note rates and can change prior to the first adjustment date. For example, if loans are paid off prior to the first adjustment date it may impact the overall weighted average of the PC coupon.

How do I account for a Neg Am factor in my calculation of monthly principal and interest payments?

Freddie Mac payment-capped ARM PCs (prefixes 39, 42, 79, 94, 96 and 5A) and structured PCs series E003 are subject to negative amortization. Negative amortization occurs when a fixed monthly payment on a mortgage is less than the interest accruing on the mortgage for that month. The excess, or deferred, interest, which cannot be paid for the month, is added to the negative amortization (Neg Am) factor, which translates any negative amortization of the underlying mortgages into a number that can be used to adjust the payment of principal and interest on the related PC or structured PC.

The following is an example of how to use the Neg Am factor in a principal and interest calculation for a July payment:

- Interest = [(Original PAR) * (May Factor) * (May Coupon) / 12] - [(Original PAR) * (June Neg Am Factor)]

- Principal = [(Original PAR) * (May Factor – June Factor)] + [(Original PAR) * (June Neg Am Factor)]

Supers, Giant MBS, Giant PCs

What are the differences between a Supers vs Giant MBS vs Giant PC?

Supers, Giant MBS and Giant PCs are single-class securities collateralized by other single-class securities. These resecuritizations may be backed by, respectively, UMBS, MBS, PCs and/or other single-class (Level 2) securitizations, as detailed below.

| Product Name (Level 2) | Eligible Collateral | Payment Delay |

|---|---|---|

| Supers | UMBS and Supers issued by either Enterprise | 55-day |

| Giant MBS | Freddie Mac 55-day MBS and Giant MBS | 55-day |

| Fixed-Rate Gold Giant PC | Freddie Mac Gold PCs and Gold Giant PCs | 45-day |

| ARM Giant PC | Freddie Mac ARM PCS and ARM Giant PCs | 75-day |

What collateral can back a Supers?

Freddie Mac fixed-rate Supers can be formed from Freddie Mac UMBS or other Freddie Mac Supers with the same coupon, term, and other characteristics. A commingled Supers can be formed from Freddie Mac and Fannie Mae UMBS and/or Supers. Refer to the Pooling Requirements for 55-day Fixed-rate Supers together with the 55-day Giant/Supers Collateral Prefix Eligibility Chart for collateral eligibility.

What collateral can back a Giant MBS?

Freddie Mac fixed-rate Giant MBS can be formed from Freddie Mac MBS or other Giant MBS with the same coupon, term, and other characteristics.

What collateral can back a Giant PC?

Freddie Mac fixed-rate Giant PCs can be formed from PCs with the same coupon, term, and other characteristics. Adjustable-Rate Giant PCs can be formed from adjustable rate collateral with the same cap, floor, adjustment period, margin, and other characteristics. Refer to the Pooling Requirements for 45-day Fixed-rate Giant PCs and Pooling Requirements for 75-day ARM Giant PCs together with the 45-day Fixed-rate and 75-day ARM Giant Collateral Prefix Eligibility Chart for collateral eligibility. Although Freddie Mac ceased issuing new 45-day Gold PCs as of May 31, Freddie Mac still allows formation of Giant PCs from existing Gold PCs and Giant PCs.

Can Multilender and Guarantor pools be combined into Supers, Giant MBS and/or Giant PCs?

Yes, you can combine both Multilender and Guarantor pools into Supers, Giant MBS and/or Giant PCs.

When during the month can I settle a Supers, Giant MBS, or Giant PC?

Supers, Giant MBS, and Giant PC settlements typically may occur beginning one business day after the factor release through the last business day of the month with the exception that these settlements may not occur on the second business day prior to REMIC settlement day.

If investors are interested in exchanging 45-day securities for 55-day UMBS or MBS and creating Supers or Giant MBS with those same 55-day UMBS or MBS, extra time should be allowed for these transactions and settlements. During the 3-6 month period following the opening of the exchange offer, investors should plan for a T+3 settlement for the creation of the Supers/Giant MBS. The exchanges will settle on T+2, the 55-day collateral is delivered to create the Supers by 11:00 am on T+3, and the Supers/Giant MBS can settle on T+3.

How soon is disclosure available on Supers, Giant MBS, or Giant PCs?

Final disclosure is generally available one business day following settlement.

Will any mirror securities be issued after June 3, 2019?

After June 3, 2019, the only mirror securities that will be issued will be for 45-day Giant PCs created from previously-mirrored 45-day Gold PCs. In this case, the mirror securities for the underlying 45-day Gold PCs would be retired and one mirror security for the 45-day Giant PC would exist instead.

Where can I find Supers, Giant MBS, or Giant PC collateral information?

The settlement collateral backing Freddie Mac Supers, Giant MBS, or Giant PC is disclosed in the Daily Issuance Security Files and the specific Pool Supplement that can be found on the Security Data and/or Security Lookup pages (respectively) of the Freddie Mac MBS website.

When looking for collateral for a specific Supers, Giant MBS and/or Giant PC, it is important to know the settlement date in order to pull the correct Daily Issuance Security File containing the settlement collateral. The final disclosure, including the collateral, for a specific Giant PC will be disclosed the day after settlement in the files listed above.

How do I deliver collateral to create a Supers, Giant MBS, or Giant PC?

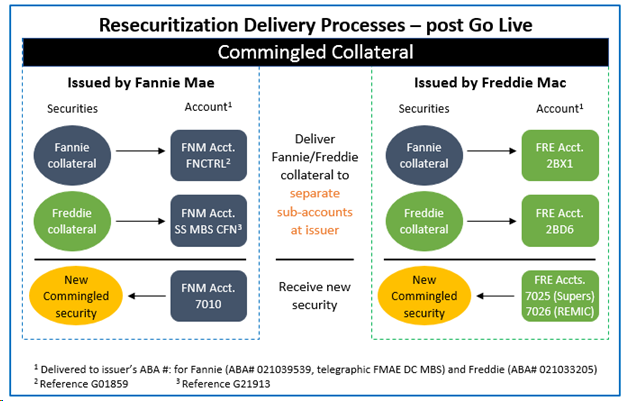

To create a Freddie-only 55-day Supers or Giant MBS, all collateral will go to Freddie Mac’s ABA #021033205, account 2BD6.

To create a Freddie-only 45-day Giant PC, all collateral will go to Freddie Mac’s ABA #021033205, account 2BD2.

To create a commingled 55-day Supers at Freddie Mac, deliver Fannie Mae and Freddie Mac collateral to separate Freddie Mac subaccounts at the Fed. All collateral will go to Freddie Mac’s ABA #021033205; Freddie Mac collateral to account 2BD6 and Fannie Mae collateral to account 2BX1. The Supers will be delivered from FRE account 7025.

Who is the guarantor on a commingled security?

The security issuer, regardless of underlying collateral, will be the guarantor on a commingled security.

How can I identify a Supers, Giant MBS, or Giant PC?

To identify what type of security you have, access the Prefix Library, then search the prefix range and pool number range to determine the security type. In general, Supers pool numbers will begin with S.

What is the minimum number of pools to create a Supers or Giant MBS?

A Supers or Giant MBS must have a minimum of 2 pools.

REMICs

Can I add 45-day collateral into a 55-day REMICs?

Yes, Freddie Mac accepts 45-day collateral in a 55-day REMIC, although payment will still occur on a 55-day delay schedule.

What collateral can back a REMIC?

55-Day Securities – UMBS, Supers, Freddie Mac MBS, Giant MBS, previously issued Freddie Mac securities whose collateral is comprised of one of the preceding types of securities and Fannie Mae REMIC or RCR Classes backed entirely by TBA-eligible collateral.

45-Day Securities – Freddie Mac Gold PCs and previously issued securities whose collateral is comprised of Gold PCs.

75-Day Securities – Freddie Mac Original PCs and ARM PCs and previously issued securities whose collateral is comprised of Original PCs and ARM PCs.

Non-TBA-eligible collateral and all 45-day PCs are not eligible collateral for Supers. Non-TBA-eligible collateral is eligible for re-securitization (Giant/Mega/REMIC) by the original issuer only.

How can I find out what new Freddie Mac REMIC or structured deals have been priced? How can I obtain information on each of the deals?

Information on recently priced or issued Freddie Mac REMIC and structured deals is available on Freddie Mac's Web site on the REMIC Pricing Report page in the Recently Priced REMICs report.

After pricing and structuring information has been finalized, information for these deals can be accessed from the Security Lookup page. Select REMIC, type in the REMIC series number, select "Structuring Information" option and click on the "Search" button.

When is disclosure available for new issues?

Timing of disclosure for newly issued REMICs varies depending on the data. For example, OCS and Structuring Reports (e.g.CUSIPs, FastREMICs, PAC Tables, assumed collateral, etc.) are generally available two business days prior to settlement. Settlement collateral should be available no later than the settlement date.

To obtain the Offering Circular Supplement, go to the Security Lookup page, select REMIC, type in the REMIC CUSIP or series number and select the "Offering Circular Supplement" option and then click on "Search".

How do I obtain CUSIP numbers for REMICs or structured deals prior to settlement?

Generally, two to five business days prior to settlement, CUSIP numbers are available on Freddie Mac's Web site and can be accessed from the Security Lookup page. Select REMIC, type in the REMIC series number, select the "Structuring Information" option and click the "Search" button.

What is the difference between an issue date and a settlement date for a REMIC?

Freddie Mac REMICs default to an issue date of the first day of the settlement month. Settlement date is the date agreed upon by the parties to a transaction (i.e., a newly issued REMIC) for the delivery of securities and payments of funds. Most Freddie Mac REMICs settle on the last business day of the month.

Freddie Mac REMIC tranches are denoted by a one or two letter convention. Do they have any particular significance or meaning?

Generally, letters used for naming REMIC classes do not have any particular meaning. However, classes that use double letters (e.g., LL) or three letters including a double letter combination (e.g., DAA), represent retail classes that may have many different characteristics than other classes. REMIC classes beginning with the letter “R” (e.g., R or RS) represent residuals. REMIC classes with the letter "Z" generally represent accrual classes. REMIC classes with the letter “O” generally represent principal only classes.

What are the minimum principal and transfer amounts for REMIC classes currently issued?

All Classes other than Retail and Residual Classes are issued, held and transferred in minimum original principal or notional principal amounts as shown below and additional increments of $1. If a Class is more than one type, its minimum is the greater of the applicable minimum amounts.

| Type of Class |

Minimum Original Principal or Notional Principal Amount |

|

|---|---|---|

|

$1,000,000 |

|

|

$100,000 |

|

|

$1,000 |

|

Retail Classes are issued, maintained and transferred in $1,000 Retail Class units. A Residual Class without an original principal amount or notional principal amount is issued in minimum percentage interests of 1%. Other Residual Classes are issued in minimum original principal or notional principal amounts of $1,000 and additional increments of $1.

Does Freddie Mac have a clean-up call for REMICs?

Freddie Mac REMICs are not subject to a clean-up call. Further, we have announced that, consistent with our prior practice, we will continue not to exercise existing clean-up call rights related to existing REMIC deals.

How do I find out when a Callable REMIC or Callable Pass-through Certificate (CPC) has been called?

Generally, at the end of the calendar month, Freddie Mac notifies the Federal Reserve Bank of New York (FRBNY) of the outstanding classes that will be retired on the next payment date. FRBNY then notifies the holders of those classes of the impending call.

On the first business day of the month of redemption, Freddie Mac will reduce the class factor for each outstanding class to zero

The Offering Circular Supplement contains a description of the call process for each deal.

I purchased a support class REMIC security. Why isn't it paying according to the schedule in the REMIC Offering Circular Supplement?

Payment schedules are based on prepayment rate assumptions, which do not reflect actual prepayments. Support classes, also referred to as companion classes, are designed to receive principal payments on any payment date only after scheduled payments have been made on the specified class that it supports. Support classes are more likely to be sensitive to mortgage prepayments rates because they support the principal stability of other classes in the REMIC. As a result, it is possible that you may not receive principal payments for extended periods of time and that the principal payments may change significantly from period to period.

Why does the factor on an Interest-only (IO) REMIC bond decline each month even though the bond doesn't pay principal?

An IO REMIC bond usually pays interest based on a declining notional (theoretical) principal balance. Typically, an IO REMIC is paired with another bond that has an actual principal balance associated with it. The notional balance of the IO declines proportionately with its paired bond's paydown when applicable.

What is an inverse floating rate tranche? How is the coupon calculated?

Inverse floating rate tranches have class coupons that are reset periodically based on an interest rate index such as the London Interbank Offered Rate (LIBOR) and that vary inversely with changes in the interest rate index.

The inverse floater can be leveraged or non-leveraged. The interest rate on leveraged inverse floaters moves up or down more than one basis point with every decrease or increase of one basis point on the index. The interest rate on a non-leveraged floater moves up or down inversely to the index on a one-to-one basis.

Inverse floating rate bonds tend to perform better as interest rates decline. Investors who seek higher yields in a declining interest rate environment tend to be interested in inverse floating rate tranches. Investors may also use inverse floating rate tranches to hedge interest rate risks in portfolios.

Do residual class holders receive payment even though both principal and interest types are non-payment residual (NPR)?

NPR bonds do not pay principal or interest during the life of the bond. However, upon surrender, the holder of the residual class will receive the proceeds of the remaining assets of the related pool after all required principal and interest payments on the related mortgage security classes have been made. The remaining assets are not likely to be significant.

How do I calculate the payment for an accrual retail bond? Do I receive principal and interest?

Accrual classes add interest accrued to the principal balance. No interest is paid on these classes, rather interest accrues during each interest accrual period at the rate specified in the Offering Circular Supplement. Payments of principal on the class are made on a pro-rata basis in $1,000 increments. The formula to calculate the monthly payment is:

Monthly Payment = Initial Net Compound Amount * Number of Units Owned * Principal Paydown Factor

NOTE: Initial net compound amount can be obtained from principal payments, net compound amounts and pre-tax yield tables as described in the corresponding Offering Circular Supplement.

The factor on my retail bond has decreased. Why haven't I received a principal payment?

The class factor for a retail class applies to the class as a whole, not to individual Retail Class Units. The class factor is a eight-digit number which, when multiplied by the original principal amount of a class, equals the remaining principal amount of that class. Investors in a Retail Class receive principal payments in Retail Class Units, each of which is $1,000. Payment of principal on a Retail Class is subject to the priorities, limitations and allocations described in the related Offering Circular Supplement.

After the amount of principal has been determined for a Retail Class on any given payment date, payment is made to those beneficial owners who have requested priority payments. Priority is given to "Deceased Owners" in an amount up to $100,000 and then to "Living Owners" in an amount up to $10,000. Thereafter, those Deceased Owners will receive a second $100,000 and the Living Owners will receive a second $10,000. This sequence of priorities is repeated until all principal requests have been honored.

If the amount of principal available for payments on any Retail Class exceeds the amount needed to honor all principal payment requests, the Depository Trust Company (DTC) will determine which Retail Class Units will be paid, using its established random lot procedures.

Each Depository Participant receiving such payments, and each financial intermediary in the chain to beneficial owners, will remit payments to their customers according to their own procedures, which may or may not be random lot. Investors may ask their brokers or other intermediaries what allocation procedures they use.

When can a request for early redemption be placed for a retail bond? When will I receive payment on a retail bond?

The beneficial owner of a retail bond can apply for an early redemption at any time by sending a written request to the Depository Trust Company (DTC) on their automated system. However, payment is made from available funds and is distributed in the following order:

- First, to the estates of each deceased owner up to the amount of $100,000, and if there are additional funds,

- Second, to each living owner requesting an early redemption by random lot procedures up to the amount of $10,000, until the funds for that payment are exhausted.

- If there is not enough principal available on a given payment date to honor all requests, the requests will be honored on following payment dates as principal becomes available.

Strips

What collateral can back a Strip?

Strips can be formed from Supers, Gold PCs, Giant MBS or XSIO cash flows. When Supers or Giant MBS are used to form a Strip they can be backed by known collateral or TBA collateral.

What is a Gold MAC?

Strips created from Freddie Mac Gold PCs are also known as Gold Modifiable and Combinable Securities (MACS or Gold MACS). Gold MACS are stripped Giant certificates with a modifiable and combinable feature that enable investors to exchange a fixed-rate Giant PC for IO, PO, or a variety of synthetic coupon PCs from a single strip offering. Additionally, a floater/inverse floater enhancement allows for floater and inverse floater pairs to be produced in addition to the synthetic coupon PCs.

What type of collateral backs a Gold MAC?

Freddie Mac Gold MACS are backed by a single newly-created Gold Giant PC that is backed by single-family fixed-rate Gold PCs.

How do I determine whether or not a certain Freddie Mac Giant or Supers backs a strip?

A listing of Freddie Mac strips and the corresponding Giants is available on Freddie Mac's Web site. The Freddie Mac Strips and Associated Giants report is available on the Strips Report page and is updated whenever a new strip is issued.

Other

How do I invest in Freddie Mac's mortgage securities?

Freddie Mac does not issue securities directly to the public. Please contact your broker if you are interested in investing in Freddie Mac mortgage securities.

What is the difference between a seller and a servicer?

A seller is an entity that sells mortgages to Freddie Mac. Freddie Mac discloses the seller's name at pool issuance. A servicer is the entity that services the loans. Freddie Mac provides servicer information and updates the information monthly. Servicing rights can be sold concurrently in the month of issuance or from entity to entity throughout the life of the mortgage.

How can I obtain paper copies of Freddie Mac's offering documents and other product materials?

Electronic copies of Freddie Mac's offering documents and other product materials are available on Freddie Mac's Web site. However, paper copies of these materials may be obtained by contacting [email protected].

What tax reporting is provided for Freddie Mac mortgage securities?

Security owners can obtain tax reporting information from Freddie Mac's Web site by going to Security Lookup, entering a CUSIP or Pool Number, clicking on "Tax Factors", and selecting a tax year from the drop down box. For tax data prior to 2019, they can find disclosure files at this link: /mbs/html/sd-pc-lookup.

Freddie Mac REMIC residual class owners are mailed a Schedule Q quarterly by Common Securitization Solutions (CSS). Freddie Mac REMIC residual holders can access their Q’s electronically prior to Q2 2019.