ACE-ing the Credit Risk Test

Freddie Mac serves America’s homebuyers, homeowners and renters by providing liquidity, stability and affordability to the housing market through all economic cycles and in all communities nationwide. Our commitment to risk management is a vital piece of this work – whether it’s managing risk (like credit or collateral) or transferring risk from taxpayers to private capital through our Credit Risk Transfer (CRT) program.

Recently, in our Q4 2023 CRT webinar, Tanya DeLia, Vice President, Collateral Risk Management, spoke about Freddie Mac’s approach to collateral evaluation – particularly, how we’re focused on developing valuation methods that provide prudent risk management while promoting consistent valuation outcomes, simplifying the loan manufacturing process and reducing costs.

One such valuation method has been around for nearly seven years: automated collateral evaluation (ACE). ACE leverages Freddie Mac models like Home Value Explorer (HVE) and our condition model, algorithms and a wealth of data to assess a property’s market value and condition. When ACE is offered on a loan, it allows a lender to accept ACE in lieu of an appraisal.

We leverage not only the value, but also the confidence score – with an eye toward ACE performing at least as well as loans supported by appraisals (on a risk-adjusted basis). Our recent research shows our observation of ACE performance.

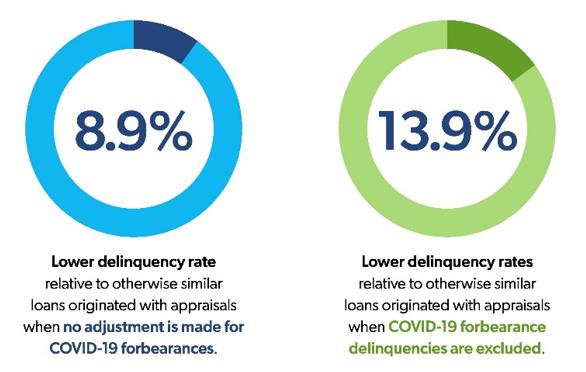

We used internal Freddie Mac data for loans originated between May 2017 and June 2023 – to allow at least six months of performance for the most recent originations – and compared the 90-day delinquency rates for loans originated using ACE and those that weren’t. Our research shows that ACE loans have an 8.9% lower delinquency rate relative to otherwise similar loans originated with an appraisal. When COVID-19 forbearance delinquencies were excluded, the advantage for ACE loans jumped to 13.9%.

A closer look at the summary statistics in our data showed that ACE loans have a better credit profile on average and, as a result, would exhibit better default performance. To address this, we weighted the group of loans that were originated with an appraisal to match the risk profile of the ACE loans group – controlling for variables like loan-to-value (LTV), FICO Score, unpaid principal balance (UPB), debt-to-income (DTI), loan purpose, product type and other factors.

After weighting, the default reduction through ACE was negligible shortly after origination but increased rapidly to ~12 basis points (bps) after 50 months seasoning in the pre-2020 sample and ~7 bps after 27 months seasoning for the post-2020 sample. Meaning that even after accounting for differences in credit characteristics, ACE loans continue to display superior default performance.

This research is great news for borrowers. It reinforces that ACE can be a successful tool for them and provides them with value – as evidenced by the 3,261,955 ACE loans in our research sample, which saved borrowers $1.63 billion in appraisal fees (assuming an average appraisal cost of $500). Additionally, lenders can benefit from ACE, through streamlined origination, expedited closing and decreased repurchase risk. And now, CRT investors also have insight into ACE results that Freddie Mac has observed.

If you’d like more information about the ACE population of loans purchased by Freddie Mac and offered through CRT deals, you can find it in our Clarity Data Intelligence tool. Want more insights from Freddie Mac’s research team? Visit Research Insights, Notes & Briefs.