Freddie Mac Ushers in First-Ever GSE Single Family CRT SOFR-Based Transaction

What is significant about STACR 2020-DNA5?

As the first-ever GSE Single-Family SOFR-based credit risk transfer (CRT) transaction, STACR 2020-DNA5 represents a significant move to reduce investors’ and Freddie Mac’s exposure to LIBOR. It demonstrates Freddie Mac’s leadership in the CRT market and commitment to our CRT investors. Also significant is that we stuck to the issuance timeline we established earlier this year, despite the adverse impact of the COVID-19 pandemic. Operationally, the transaction is the same as our earlier process (the index rate is set two business day prior to the start of the accrual period), except that it uses the 30-day compounded average SOFR index instead of LIBOR. Our goal was to make the transition as seamless as possible for CRT market participants.

What did the LIBOR transition process that led up to the transaction entail?

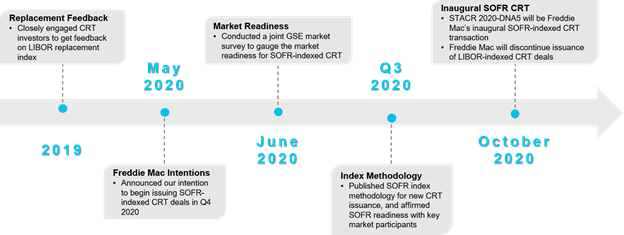

Freddie Mac’s CRT team began preparing for the transition almost two years ago, after the United Kingdom Financial Conduct Authority (FCA) announced it will no longer persuade or compel member panel banks to make London Interbank Offered Rate (LIBOR) submissions after 2021. Under the guidance of the Federal Housing Finance Agency (FHFA), the team worked closely with Fannie Mae to ensure an aligned approach in our transition to SOFR-based CRT issuances.

Input from CRT market participants has been critical for a successful transition. Based on initial market feedback and to help prepare the market for a smooth transition, Freddie Mac released our CRT LIBOR Transition Playbook and FAQs in May 2020 that laid out the roadmap to transition to SOFR-based STACR® (Structured Agency Credit Risk) issuance in the fourth quarter of 2020. Working with Fannie Mae, we proactively solicited feedback from CRT investors, broker/dealers and other key market participants regarding SOFR index methodology. Based on the feedback, we settled on the 30-day compounded average SOFR published by the NY Fed with a determination date of two business days prior to the beginning of the accrual period as the reference rate for CRT securities. We also determined that most market participants would be ready for SOFR-indexed CRT transactions by the end of the third quarter, a key element in Freddie Mac’s decision to issue the inaugural SOFR-based STACR transition in Q4 2020.

How was STACR 2020-DNA5 received by the market?

All tranches in STACR 2020-DNA5 were oversubscribed at least three times at launch of the transaction. More than 55 unique investors participated in the deal, including three new accounts, which brought our 2020 count of unique investors to over 100 for the first time since 2015.

Will STACR 2020-DNA5 be the last Freddie Mac Single-Family CRT security issued in 2020?

The STACR 2020-DNA5 reference pool only includes the first half of second quarter 61-80 LTV securitizations. We expect to have two more transactions before year end (subject to market condition), including another transaction to cover the remainder of second quarter 61-80 LTV securitizations (STACR 2020-DNA6) and a transaction that will cover 81-97 LTV loans securitized in Q2 2020 (STACR 2020-HQA5).

Transition Timeline to SOFR-Indexed CRT Issuance