September 23, 2023 Enhancements

On September 23, 2023, we enhanced Clarity Data Intelligence (Clarity) to improve your experience when using our Historical dashboards to get the data you need. See what we’ve updated to continue providing you transparency and relevant data.

Tranche Filter Added to CRT Tranche Level Dashboard

When using the CRT Tranche Level Dashboard, you’ll notice there’s a new drop-down ‘Tranche’ filter. This new feature now allows users to easily analyze activities and balances for specific tranches as well as filtering out tranches that are no longer outstanding.

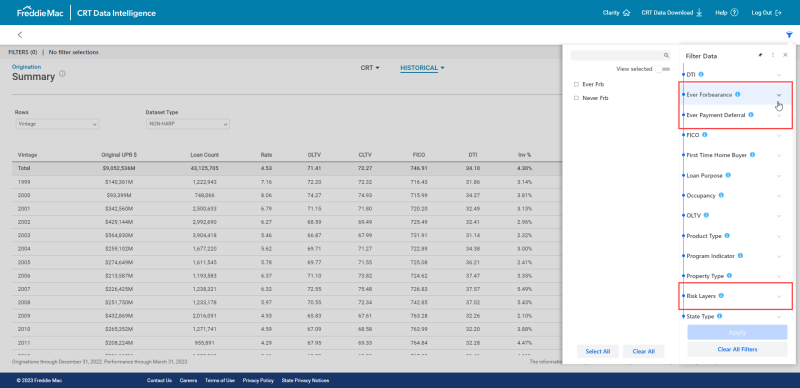

New Global Filters in the “Historical” Section

In the “Historical” section, enhancements were made to enable the same filters as the “CRT” section. Ever Forbearance, Ever Payment Deferral and Risk Layers are now available across all the “Historical” dashboards. This new feature allows users to further analyze credit and performance for loans in these categories.

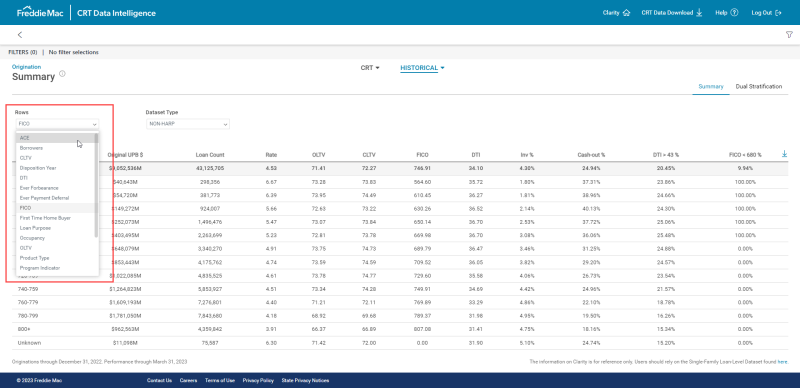

New Drop-down Options on Historical Dashboards

There are now 14 new drop-down options for you to select on the Origination Summary, Dual Stratification (six net-new options), Performance Summary and Loss Details dashboards to give you more options to group and analyze the Historical dataset.

Those new options include ACE, Borrowers, FICO, FTHB (first-time homebuyer), Loan Purpose, Occupancy, Product Type, Program Indicator, Property Type, State Type, Zero Balance, Ever Forbearance, Ever Payment Deferral, and Risk Layers.

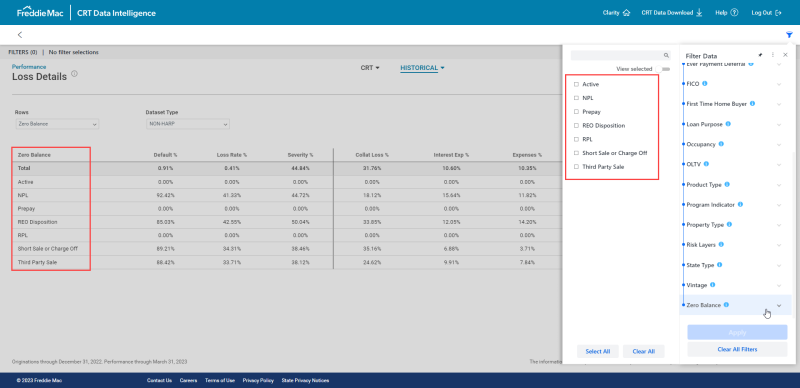

Zero Balance Filter

To provide more transparency for various credit events, the “Zero Balance” filter now displays all credit events separately instead of grouping certain categories. “Zero Balance” are categorized into active, prepay, short sale/charge off, third-party sale, REO disposition, reperforming loan offering (RPL), and non-performing loan offering (NPL).