Stripped Supers/Giant Certificates (Strips)

Freddie Mac offers Strips that can be formed from Supers and Giant MBS. Strips have a modifiable and combinable feature that provides investors with synthetic coupon options and the option to exchange the Interest Only (IO) and Principal Only (PO) classes for the underlying collateral (Supers or Giant MBS as applicable).

Supers: Supers are single-class securities that are TBA-eligible and receive principal and interest from their underlying assets. Supers bear interest at a fixed rate.

Giant MBS: Giant MBS are single-class securities that are not TBA-eligible and receive principal and interest from their underlying assets. Giant MBS bear interest at a fixed rate or an interest rate subject to Step Rate Increases.

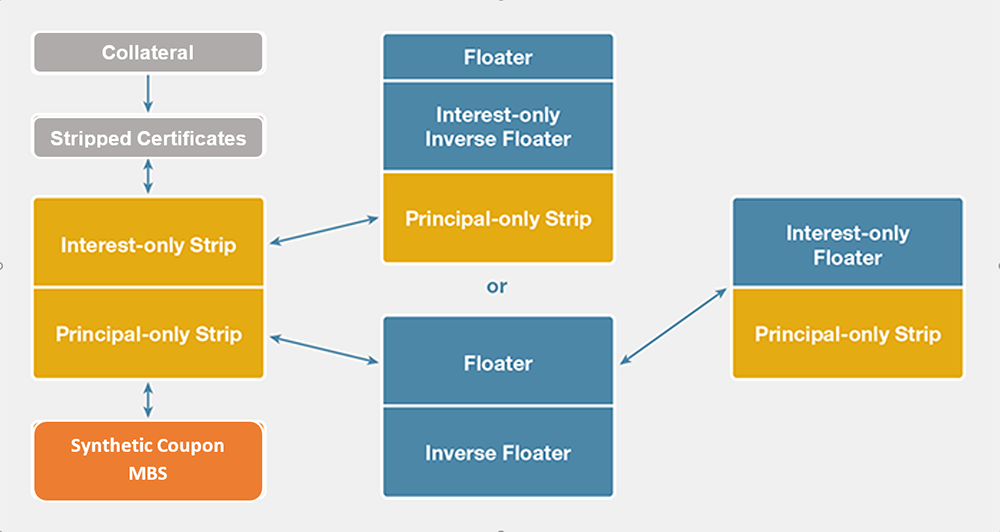

Stripped Certificates: Stripped Certificates are issued in series consisting of two or more classes that receive principal only, interest only or both principal and interest from a single underlying asset. Each series is backed by a single security (e.g., a Supers or a Giant MBS). If you own proportionate amounts of each of the classes from the same series, you may exchange them for an equivalent amount of the underlying asset, and vice versa.

Modifiable And Combinable Securities (MACS): MACS are Stripped Certificates issued in series consisting of a fixed rate interest only class, a principal only class and multiple fixed rate classes that receive both principal and interest with different class coupons, ranging from deep discount to high premium coupons. A series of MACS also may include multiple floating rate, inverse floating rate and weighted average coupon classes, some of which receive both principal and interest and some of which are interest only classes. If you own appropriate amounts of MACS classes, you may exchange them for other classes of the same series with different class coupons or interest rate formulas, or for an equivalent amount of the underlying asset, and vice versa.

Stripped Interest Certificates: Stripped Interest Certificates are issued in series consisting of one or more classes that receive interest payments from one or more assets. Each series is backed by a portion of interest payments from Mortgages included in various pools that back UMBS, Freddie Mac MBS or PCs.

Strip Products

Known Collateral Strips

Through the Known Collateral program, Freddie Mac’s transaction managers work with strip traders to identify coupons that warrant investor demand. Freddie Mac then offers these syndicated Strips with exact collateral stipulations (WAC, WAM and WALA) to dealers in exchange for TBA collateral.

To Be Announced (TBA) Strips

A TBA Strip provides an alternative vehicle to meet investor demand for a Freddie Mac Strip. As with Known Collateral Strips, Freddie Mac will work with dealers to identify the coupon to strip and set the collateral stipulations.

Excess Servicing IO Strips

Through the Excess Servicing IO program, Freddie Mac provides servicers with liquidity for their retained servicing (above core). Excess yield cash-flow streams from loans sold to Freddie Mac are guaranteed and securitized. Freddie Mac will also provide structuring advice and a bid for the resulting securities. These transactions are negotiated with servicers on a case by-case basis.